How To Claim Your State Of Wisconsin Unclaimed Money: A Step-by-Step Guide

Alright folks, let’s talk about something that could literally change your financial game—state of Wisconsin unclaimed money. You might be thinking, “What the heck is unclaimed money?” Well, it’s basically cash, checks, or assets that belong to you but somehow got lost in the system. Maybe it’s an old forgotten bank account, a refund from a utility company, or even life insurance benefits. Whatever it is, it’s YOUR money, and the state of Wisconsin has it sitting there, waiting for you to claim it. So buckle up, because we’re about to dive deep into this treasure hunt!

Now, I know what you’re thinking. “Is this some kind of scam?” Nope, not at all. This is legit, folks. Every state in the U.S., including Wisconsin, has a program dedicated to tracking down and returning unclaimed funds to their rightful owners. The state of Wisconsin alone holds millions of dollars in unclaimed money, and chances are, some of it might belong to you or someone you know. So why leave free cash on the table? Let’s get started.

Before we jump into the nitty-gritty, here’s a quick heads-up: this isn’t just about finding money; it’s about securing what’s rightfully yours. In this guide, we’ll walk you through everything you need to know about unclaimed money in Wisconsin, from how it works to how to claim it. Let’s make sure that cash doesn’t stay lost forever, shall we?

What Exactly is State of Wisconsin Unclaimed Money?

Let’s break it down. Unclaimed money refers to any financial assets that have been inactive or unclaimed by their rightful owner for a certain period of time. In Wisconsin, this can include things like forgotten bank accounts, unpaid wages, utility deposits, tax refunds, insurance payouts, and even stocks or bonds. The state takes custody of these funds after a specific period (usually three to five years) if the owner can’t be located.

So why does this happen? Well, people move, change names, or simply forget about accounts they once had. Businesses and organizations are required by law to turn over these abandoned funds to the state, which then holds them until the rightful owner comes forward to claim them. It’s a win-win situation—if you’re the owner, you get your money back, and the state gets to hold onto it until you do.

Why Should You Care About Unclaimed Money?

Here’s the kicker: there’s a good chance YOU have unclaimed money out there. According to the National Association of Unclaimed Property Administrators (NAUPA), billions of dollars in unclaimed property are held by states across the U.S. every year. And guess what? Wisconsin isn’t exempt from this trend. In fact, the state holds millions of dollars in unclaimed funds, and a significant portion of that could belong to you.

- Deadliest Catch Wild Bill Age

- Jazzy Anne Age

- Ivy Ball Age

- Where Was Jimmy Failla Born And Raised

- Nate Ortega Age

Think about it. Maybe you moved out of state years ago and forgot about a utility deposit. Or maybe you had a savings account that got closed because of inactivity. These are all examples of unclaimed money, and they add up faster than you think. By taking the time to search for and claim your unclaimed funds, you could be looking at a nice little windfall.

How Does the State of Wisconsin Handle Unclaimed Money?

Wisconsin has a robust system in place to manage unclaimed property. The state’s Department of Administration (DOA) is responsible for overseeing the unclaimed property program, which includes everything from tracking down lost funds to returning them to their rightful owners. Here’s how it works:

- Escheatment Process: When a business or organization can’t locate the owner of certain assets after a set period, they’re required to turn those assets over to the state. This process is called escheatment.

- State Custody: Once the funds are turned over, the state holds them indefinitely until the rightful owner comes forward to claim them. This means there’s no time limit for claiming your unclaimed money in Wisconsin.

- Search and Match: The state actively works to reunite unclaimed funds with their owners by conducting searches and matching names with public records. However, it’s up to you to take the initiative and search for your own unclaimed money.

It’s worth noting that Wisconsin doesn’t charge any fees for claiming unclaimed property. All you need to do is prove ownership, and the state will return your funds without any hassle. Pretty sweet deal, right?

Types of Unclaimed Property in Wisconsin

Now that you know how the system works, let’s talk about the different types of unclaimed property you might find in Wisconsin. Here’s a quick rundown:

- Bank Accounts: Savings, checking, or other types of accounts that have been inactive for a long time.

- Insurance Policies: Life insurance benefits or other types of insurance payouts that haven’t been claimed.

- Utility Deposits: Deposits made to utility companies that were never returned.

- Payroll Checks: Unclaimed wages or bonus checks from previous employers.

- Tax Refunds: State or federal tax refunds that were never claimed.

- Stocks and Bonds: Forgotten investments or securities that belong to you.

As you can see, the list is pretty extensive. And the best part? All of this money is just sitting there, waiting for you to claim it. So why not give it a shot?

How to Search for Unclaimed Money in Wisconsin

Alright, here’s the fun part—actually searching for your unclaimed money. The process is surprisingly simple, and it starts with a quick online search. Here’s how you do it:

Step 1: Visit the Official Wisconsin Unclaimed Property Website

Head over to the Wisconsin Department of Administration’s unclaimed property website (www.wisconsin.gov). This is the official portal for searching unclaimed funds in the state.

Step 2: Enter Your Information

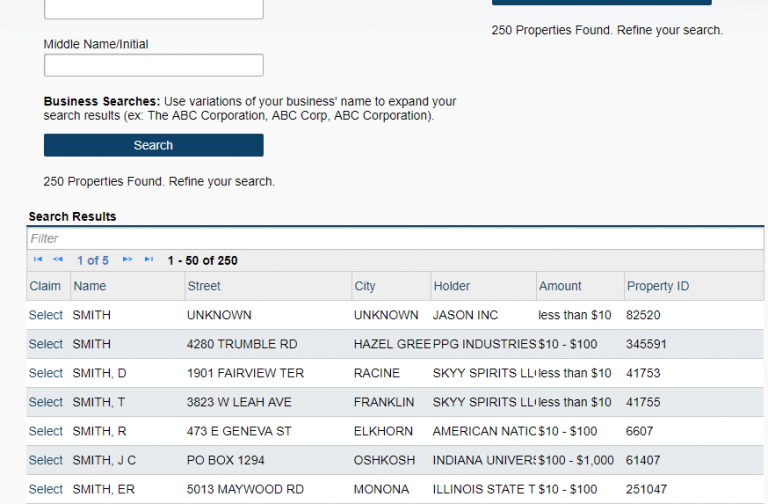

Once you’re on the website, you’ll be prompted to enter your name and any other relevant details, like a city or zip code. The search tool will then scan the database for any matches.

Step 3: Review the Results

If the system finds any matches, you’ll see a list of potential unclaimed funds. Take a moment to review each entry carefully. If you recognize any of the assets as yours, proceed to the next step.

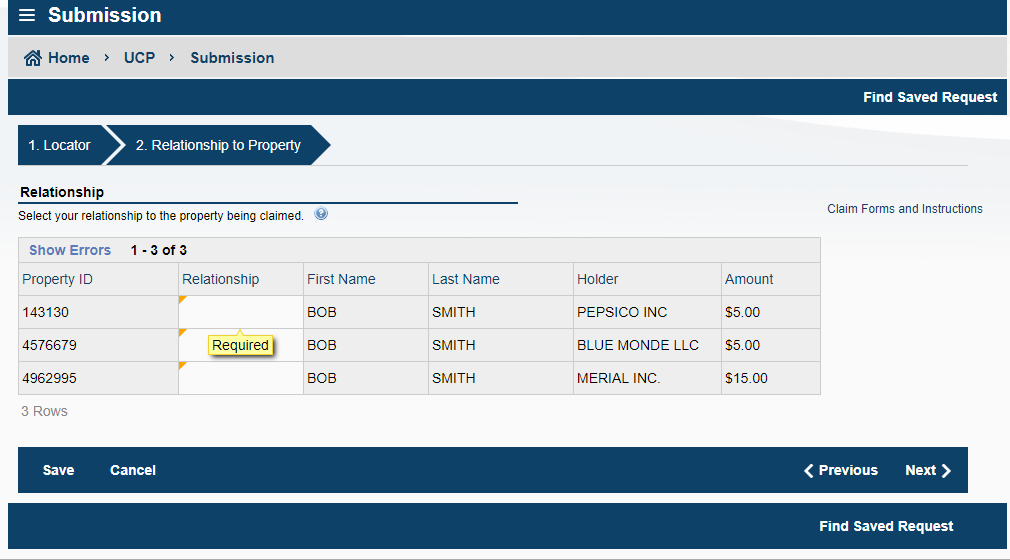

Step 4: File a Claim

To claim your unclaimed money, you’ll need to fill out a claim form and provide proof of ownership. This usually involves submitting documents like a copy of your ID, proof of address, or any other relevant paperwork. Once your claim is submitted, the state will review it and process your request.

Tips for a Successful Search

Here are a few tips to help you maximize your chances of finding unclaimed money:

- Use Variations of Your Name: If you’ve ever changed your name (e.g., due to marriage), try searching with both your current and previous names.

- Check Alternate Spellings: Sometimes, names can be misspelled in the database. Try searching with alternate spellings to cover all your bases.

- Include Former Addresses: If you’ve lived in different parts of Wisconsin, include those addresses in your search to increase your chances of finding matches.

Remember, the more information you provide, the better your chances of uncovering hidden funds. So don’t be afraid to dig deep and explore all possibilities.

Common Misconceptions About Unclaimed Money

Before we move on, let’s clear up some common misconceptions about unclaimed money in Wisconsin:

- It’s a Scam: False. The state of Wisconsin’s unclaimed property program is legitimate and regulated by law.

- There’s a Time Limit: Nope. You can claim your unclaimed money anytime, as long as you can prove ownership.

- It Costs Money to Claim: Not true. The state doesn’t charge any fees for claiming unclaimed property.

By understanding these facts, you can approach the process with confidence and avoid falling for any scams or misinformation.

How to Avoid Losing Money in the Future

Now that you know how to claim unclaimed money, let’s talk about how to prevent losing it in the first place. Here are a few tips:

- Keep Track of Accounts: Regularly review your bank statements and other financial records to ensure nothing gets forgotten.

- Update Contact Information: If you move or change your name, make sure to update your information with all relevant businesses and organizations.

- Claim Refunds Promptly: Don’t let utility deposits or tax refunds sit unclaimed for too long.

By staying organized and proactive, you can avoid the headache of having to search for unclaimed money in the future.

Success Stories: Real People, Real Money

Let’s talk about some real-life success stories of people who found and claimed unclaimed money in Wisconsin. These stories are proof that the system works and that you could be next in line for a financial windfall:

Story 1: The Forgotten Bank Account

John Smith, a resident of Madison, discovered he had an old savings account with over $5,000 in it. He had completely forgotten about the account until he ran a search on the Wisconsin unclaimed property website. After submitting a claim and providing proof of ownership, John was reunited with his long-lost funds.

Story 2: The Utility Deposit

Sarah Johnson, a Milwaukee native, found out she was owed a $300 utility deposit from a company she did business with years ago. She filed a claim, and within a few weeks, the money was back in her hands.

These stories show that unclaimed money isn’t just a myth—it’s a real opportunity for Wisconsinites to recover lost assets.

How to Stay Informed About Unclaimed Money

Finally, let’s talk about how to stay informed about unclaimed money in Wisconsin. Here are a few resources to keep you in the loop:

- Wisconsin Department of Administration: The official website for unclaimed property in Wisconsin.

- NAUPA: The National Association of Unclaimed Property Administrators provides valuable information about unclaimed property nationwide.

- Local News Outlets: Keep an eye on local news for updates and stories about unclaimed money in your area.

By staying informed, you’ll be better equipped to take advantage of opportunities to claim your unclaimed money.

Conclusion: Take Action Today!

There you have it, folks—a comprehensive guide to finding and claiming your state of Wisconsin unclaimed money. Whether you’re looking for a forgotten bank account, a utility deposit, or even life insurance benefits, the process is straightforward and accessible to everyone. So why wait? Head over to the Wisconsin unclaimed property website and start your search today.

And don’t forget to share this article with your friends and family. You never know who else might have unclaimed money waiting for them. Together, let’s make sure no one leaves free cash on the table. Now go out there and claim what’s rightfully yours!

Table of Contents

How to Claim Your State of Wisconsin Unclaimed Money: A Step-by-Step Guide

What Exactly is State of Wisconsin Unclaimed Money?

Why Should You Care About Unclaimed Money?

How Does the State of Wisconsin Handle Unclaimed Money?

Types of Unclaimed Property in Wisconsin

How to Search for Unclaimed Money in Wisconsin

Common Misconceptions About Unclaimed Money

How to Avoid Losing Money in the Future

Success Stories: Real People, Real Money

How to Stay Informed About Unclaimed Money

Detail Author:

- Name : Prof. Bria Smitham

- Username : loraine59

- Email : wjones@baumbach.com

- Birthdate : 1977-07-26

- Address : 4525 Gusikowski Ford Apt. 074 Coleville, MT 31984-9809

- Phone : +1-541-808-9421

- Company : Bechtelar Ltd

- Job : Software Engineer

- Bio : Eius voluptatem autem autem sapiente ratione officiis. Magni sed ab sed officia. Nisi aut ea aut neque et quo.

Socials

linkedin:

- url : https://linkedin.com/in/quentin.ryan

- username : quentin.ryan

- bio : Autem ut voluptate non aut ut aut magnam.

- followers : 337

- following : 946

twitter:

- url : https://twitter.com/ryan2024

- username : ryan2024

- bio : Sit nihil non aut omnis. Non quidem debitis sit quod quod tempore. Esse debitis vel tenetur fugiat qui.

- followers : 2161

- following : 1810