Pay Property Tax Pinellas County: A Comprehensive Guide To Stay On Top Of Your Financial Obligations

Property tax payments can sometimes feel like a daunting task, but don’t sweat it. If you're a resident of Pinellas County, understanding how to pay property tax Pinellas County is essential for maintaining your financial health and avoiding unnecessary penalties. Whether you're a first-time homeowner or a seasoned property owner, this guide will walk you through everything you need to know about paying property taxes in Pinellas County. So, grab a cup of coffee, and let's dive right in!

Let's face it, property taxes are a part of life when you own real estate. But hey, it's not all doom and gloom. Paying your property tax on time can actually save you money in the long run by avoiding late fees and interest charges. In Pinellas County, the process is pretty straightforward if you know where to look and what steps to follow. This article will break it all down for you so you can manage your obligations with ease.

We'll cover everything from the basics of property tax to the various methods you can use to pay them. Plus, we'll throw in some tips and tricks to help you stay organized and stress-free. So, whether you're dealing with a brand-new property or just trying to get your financial ducks in a row, this guide's got you covered.

Understanding Property Tax in Pinellas County

What Exactly is Property Tax?

Property tax is essentially a fee imposed by local governments on property owners based on the assessed value of their property. In Pinellas County, this tax funds essential services such as public schools, emergency services, infrastructure, and more. It's important to understand that property tax rates can vary depending on your location within the county and the type of property you own.

For instance, residential properties might have different tax rates compared to commercial properties. The tax is calculated by multiplying the assessed value of your property by the millage rate set by the local government. Don't worry if that sounds confusing; we'll simplify it further as we go along.

How Does Pinellas County Assess Property Values?

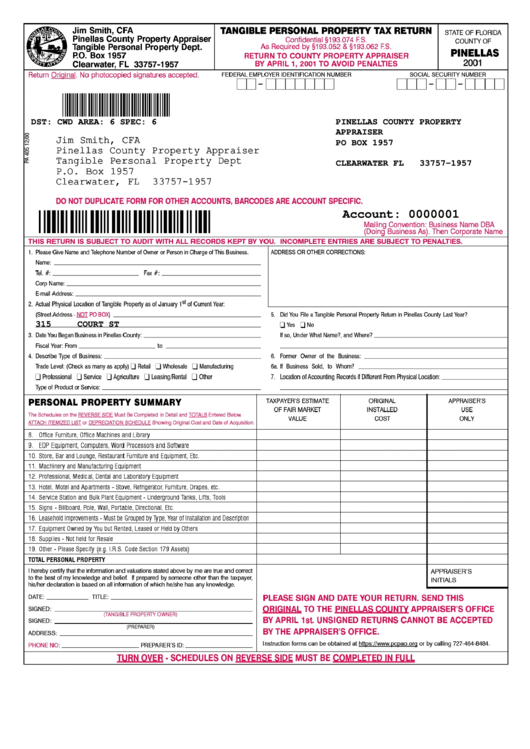

The Pinellas County Property Appraiser's Office is responsible for assessing property values annually. They use a combination of market analysis, property inspections, and other data to determine the fair market value of each property. This assessed value is then used to calculate your property tax bill.

- Market Analysis: The appraiser looks at recent sales of similar properties in your area.

- Property Inspections: Physical inspections may be conducted to ensure the accuracy of the assessment.

- Data Collection: Other relevant data, such as improvements or renovations, are also considered.

It's worth noting that property values can fluctuate from year to year based on market conditions and changes to the property itself. So, it's a good idea to keep an eye on your assessment notices and contest them if you believe they're inaccurate.

Steps to Pay Property Tax Pinellas County

Option 1: Pay Online

One of the easiest and most convenient ways to pay your property tax in Pinellas County is through the official website. The Pinellas County Tax Collector's Office provides a secure online portal where you can make payments using a credit card or electronic check. Here's how you can do it:

- Visit the Pinellas County Tax Collector's website.

- Locate the "Pay Taxes" section and click on it.

- Enter your parcel identification number or property address.

- Select your payment method and follow the prompts to complete the transaction.

Online payments are typically processed quickly, and you'll receive a confirmation email once the payment is successful. Just make sure to keep a record of your payment for your records.

Option 2: Pay by Mail

If you prefer the old-school method, you can always pay your property tax by mail. Simply send a check or money order to the Pinellas County Tax Collector's Office along with your payment stub. Be sure to include your parcel identification number on the check to ensure proper crediting of your payment.

Here's the address you'll need:

Pinellas County Tax Collector's Office

PO Box 5479

Clearwater, FL 33758

Remember to mail your payment early enough to ensure it arrives by the deadline to avoid any late fees.

Option 3: Pay in Person

For those who like to handle things in person, the Pinellas County Tax Collector's Office has several locations where you can pay your property tax. You can pay with cash, check, or credit card at any of these offices during regular business hours.

Just be sure to bring your payment stub and any other necessary documentation. And don't forget to get a receipt as proof of payment!

Important Deadlines and Penalties

Know Your Due Dates

Property tax bills in Pinellas County are typically issued in November, and the payment deadline is usually in March of the following year. However, paying early can often result in discounts or avoid additional charges. Here's a breakdown of the key dates:

- November: Tax bills are mailed out.

- January: Early payment discount period ends.

- March: Final payment deadline to avoid penalties.

Staying on top of these deadlines can save you a lot of hassle and money. Make sure to mark them on your calendar or set reminders to ensure you don't miss them.

Penalties for Late Payments

If you fail to pay your property tax by the deadline, you'll likely face penalties and interest charges. These can add up quickly, so it's crucial to avoid them if possible. In Pinellas County, the penalties may include:

- A percentage of the unpaid tax as a late fee.

- Accruing interest on the outstanding balance.

- Possible legal action if the tax remains unpaid for an extended period.

So, it's always better to pay on time or even early if you can swing it.

Common Questions About Paying Property Tax Pinellas County

What Happens if I Disagree With My Property Assessment?

If you believe your property assessment is inaccurate, you have the right to contest it. The first step is to contact the Pinellas County Property Appraiser's Office to discuss your concerns. They may conduct a reassessment or provide additional information to clarify the valuation.

If you're still not satisfied, you can file an appeal with the Value Adjustment Board (VAB). This process involves presenting evidence to support your case and may result in a revised assessment.

Can I Set Up Automatic Payments?

Absolutely! Many property owners prefer to set up automatic payments to ensure they never miss a deadline. You can arrange this through the Pinellas County Tax Collector's Office by providing your bank account information. Just make sure to keep sufficient funds in your account to cover the payment.

What If I Can't Afford to Pay My Property Tax?

If financial difficulties are preventing you from paying your property tax, there are some options available. You may qualify for a tax deferral program or payment plan. Contact the Pinellas County Tax Collector's Office to explore these possibilities and find a solution that works for you.

Tips for Managing Property Tax Payments

Stay Organized

One of the best ways to manage your property tax payments is to stay organized. Keep all your tax-related documents in one place, including your assessment notices, tax bills, and payment confirmations. This will make it easier to track your payments and contest any discrepancies if needed.

Set Reminders

With busy schedules and competing priorities, it's easy to forget important deadlines. Set reminders on your phone or calendar to ensure you don't miss any payment due dates. You can also sign up for email notifications from the Pinellas County Tax Collector's Office to stay informed.

Review Your Tax Bill

Don't just pay your tax bill without giving it a second look. Review the details to ensure everything is accurate, including your property description, assessed value, and tax amount. If you spot any errors, contact the Tax Collector's Office immediately to resolve the issue.

Understanding the Impact of Property Tax on Your Finances

How Property Tax Affects Your Budget

Property tax is a significant expense for most homeowners, so it's important to factor it into your overall budget. Depending on the value of your property and the local tax rate, your annual property tax bill could range from a few hundred to several thousand dollars. Planning ahead and setting aside funds specifically for property tax payments can help you avoid financial strain.

Long-Term Financial Planning

When buying a new property in Pinellas County, don't forget to consider the ongoing cost of property taxes. This can impact your decision-making process and help you determine whether a particular property fits within your budget. Additionally, keeping up with property tax payments can positively affect your credit score and financial stability over time.

Resources for Further Assistance

Pinellas County Tax Collector's Office

For more information about paying property tax in Pinellas County, the Tax Collector's Office is your go-to resource. Their website provides detailed guides, FAQs, and contact information for further assistance. You can also reach out to them via phone or email if you have specific questions or concerns.

Local Tax Professionals

If you're feeling overwhelmed by the process, consider consulting a local tax professional. They can help you navigate the complexities of property tax and ensure you're taking advantage of all available deductions and credits. Plus, they can provide personalized advice based on your unique financial situation.

Conclusion

Paying property tax in Pinellas County doesn't have to be a stressful experience. By understanding the process, staying organized, and utilizing the available resources, you can manage your obligations with confidence. Remember to pay attention to deadlines, contest inaccurate assessments, and explore payment options that work best for you.

So, take control of your finances and make sure your property tax payments are always on track. And don't forget to share this guide with friends and family who might find it helpful. Together, we can all keep our property tax game strong!

Table of Contents

- Understanding Property Tax in Pinellas County

- Steps to Pay Property Tax Pinellas County

- Important Deadlines and Penalties

- Common Questions About Paying Property Tax Pinellas County

- Tips for Managing Property Tax Payments

- Understanding the Impact of Property Tax on Your Finances

- Resources for Further Assistance

- Conclusion

Detail Author:

- Name : Dr. Cullen Kemmer

- Username : gheaney

- Email : robyn.cronin@abernathy.com

- Birthdate : 1996-04-09

- Address : 903 Hickle Avenue East Moseview, GA 80957-3067

- Phone : 1-571-810-4134

- Company : Prohaska Group

- Job : House Cleaner

- Bio : Aut iste eum aut similique sunt repellendus. Ipsam qui quod nemo non accusamus.

Socials

instagram:

- url : https://instagram.com/bruce_brown

- username : bruce_brown

- bio : Esse ad quisquam distinctio quia ab. Dolorum odit unde fuga. Totam optio sit nostrum.

- followers : 4602

- following : 1435

twitter:

- url : https://twitter.com/bruce_brown

- username : bruce_brown

- bio : Hic nesciunt vero ipsa in quis praesentium aut. Eos adipisci maiores quis expedita sed similique hic.

- followers : 6817

- following : 1672

facebook:

- url : https://facebook.com/brucebrown

- username : brucebrown

- bio : Et sapiente tenetur placeat explicabo non quod.

- followers : 1148

- following : 2456

tiktok:

- url : https://tiktok.com/@brucebrown

- username : brucebrown

- bio : Ut perspiciatis quia repellat quia earum iste et. Consequatur sit non error.

- followers : 1586

- following : 170